Deferit

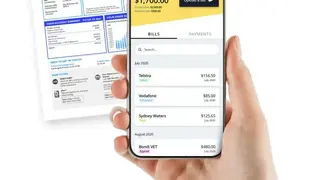

Deferit is a billing and budgeting platform that allows you to pay bills in fortnightly installments and make your budget go the extra distance needed. This eliminates the hassle of paying bills after the due date and also paying the fine due to late submission. A highlighting feature of this app is the discounts that you can avail yourself of after paying bills on time. The process is simple; you just have to take a picture of your bill or send it into a PDF file.

Choose the amount of bill to pay and let the Deferit do the rest. Bill is split into four installments every two weeks. Additionally, there is no interest or their own fees. This is your all-in-one budgeting tool that keeps track of all your bills, gets remainders, pays in installments so that you never miss the due date. The app is one of the most popular billing platforms in Australia that makes this task easier by sitting on your couch.

Deferit Alternatives

#1 Clearly Payments

Clearly Payments is a platform made for merchants that allows you to accept credit cards either in-store via mobile or online. This provides end-to-end payment processing that provides a seamless down-to-cost drive for businesses to accept credit cards. The platform has the lowest fee for a merchant account. Clearly Payments provides a complete point of sales system for retailers, restaurants, and other businesses. The POS system can be mobile or countertop type with full capabilities for managing the product inventory, variation, kitchen workflow, scheduling, and much more. It also includes a full set of receipt printers, barcode scanners, and POS stands.

The payment systems are wired and wireless with chip, pin, swipe and tap to pay systems. These are some of the most reliable credit card machines for payments and are ready to use for stores and offices. Another notable feature is that it turns your current computer into a full payment system without needing to buy extra hardware. You just need a browser on the PC for the virtual terminal, and you are good to go.

#2 Clearpay

Clearpay is a fully integrated payment method and credit card processing platform that gives you the flexibility of buying now and paying later. You can pay the bills and payments in four easy fortnightly installments. You can shop from thousands of shops and brands in the beauty, fashion, clothing, automotive, homeware, and many other categories. With the Clearpay app, you can make your payment plans and enjoy interest-free payments. The app reminds you about your upcoming installments, so you never miss the due date.

You can see your spending and have a look at your budget too. The process is simple; you just have to make an account, browse from thousands of brads, see your installments and choose Clearpay as your payment method. Make the first four payments at the time of purchase and the other payments over the six weeks. You can check your available spend and stay within budget. Moreover, spend wisely with limits that gradually increase with on-time payments.

#3 Humm

Humm is a buy now and pays later app that allows you to purchase things up to $30000 with up to 24 months to pay. You can shop interest-free and without any hidden charges. This platform helps you focus on the little joys of life that you want to buy but without worrying about the price. The pricing and installments come in two packages. If you want to spend up to $2000, you have to repay in 5 fortnightly or ten weekly slices.

With the time you pay the installments, you are freeing up your balance to spend again. The other package is the Buy Big Things package that gets you pre-approves for $5000 online or via the app. You can apply in-store for up to $30,000 and repay over 6, 12, or 24 months. The TAPP features let you pay via the contactless method when you shop in-store. All in all, Humm is a great app that you can use among its alternatives.

#4 QuickFee

QuickFee is a payment solution that helps businesses grow in many ways. It provides multiple payment options that attract more customers, builds better client relationships, improves cash flow, and ultimately increase sales. Online payments are now simpler that allows your client to pay with a credit card, ACH, e-check, or monthly payment plans. QuickFee is compatible with most of the management software. You can use it to accept payments on your website, by email, or anywhere else you can insert a payment button.

The customers have the flexibility of paying the invoice over 3 to 12 months all that without any markup or hidden charges. It also reminds you to pay the installment on time, so you never miss the due date. You can pay into four monthly installments. As a merchant or retailer, you can accept payments 24/7. Funds will be in your bank account within three business days, no matter what option your client selects. All in all, QuickFee is a great option for all your payment operations that you can use to upscale your business.

#5 CareTime

CareTime is an integrated payment processing solution that lets you rapidly, securely, and effortlessly accept payments. With its electronic visit verification and documentation system, it provides accuracy, compliance, and accountability via geolocation and telephony check-in & check-out. It lets you manage your finances and cash flow through a simple, unified experience with flat-rate, transparent pricing.

CareTime’s intuitive tools process customer’s availability, requirements, and more to set appointments and manage schedules. It lets you easily fill shifts by viewing customer’s locations to see who is within proximity of the client. You can improve customer retention and satisfaction by giving them the flexibility to pay how they choose. You can accept credit cards, ACH, even recurring payments and track everything with robust analytics and dashboards to make integration easy and quick.

#6 Bread

Bread is a buy now and pay later platform that lets you buy things in easy installments. The platform expands its service from consumers to e-commerce merchants and retailers. It offers convenient ways to buy the things you want to buy now and pay later. You can add the items to your cart and get a real-time decision without affecting your credit card. The installment plan can be set by yourself without any APR rates. The benefit of this platform is that all the payments are transparent, there are no hidden charges.

A highlighting feature of Bread is the automatic payments that let you schedule payments before the due date. Moreover, you can change the due date and re-schedule the payment as you want. Bread’s seamless plug-in and direct API integrates with your existing platform and can be customized to fit your experience. All in all, Bread is a great white-labeled payment solution that helps you grow by keeping your brand front and center.

#7 I2c

I2c is an open API card issuing, payment processing, and digital banking platform that allows you to create payment card programs and have flexibility in billing options. The platform is made for merchants and retailers that can provide customers with benefits and have more revenue from their business. Its advanced building block processing technology provides a vast suite of credit, debit, and prepaid solutions. With Buy Now Pay Later, you can provide customers with more financial control to make purchases more affordable while driving volume and spend frequency.

The platform provides ease of use to customers and lets them pay with flexible installment plans. Some highlighting features are flexible risk, making decisions on the spot, APR adjustment, repayment controls that can be adjusted in real-time, and customizing the end-user experience with end-to-end servicing and reconciling capabilities. All in all, I2c is a great multipurpose platform that you can use to make financial operations easier than ever before.

#8 Openpay

Openpay is an app that provides online financial services like loans, with a tagline of buy now, pay later. Its service is designed to allow customers to pay for items purchased using interest-free installments. The process is simple; you just have to sign up, find the things that you need from merchants, and pick a plan that suits you and pay in easy installments. The Openpay has partnered up with multiple merchants in categories like automotive, beauty, dental, fashion, healthcare, home, lifestyle, sports, etc.

The app lets you shop responsibly with more time to pay and not restricting on to things that you want and need. Now you can divide the cost of your bills, kitchen items, car tires, etc. The price can be paid in fortnightly installments with any hidden fees and charges. Along with that, you can select the installment period from 2 to 24 months. The app tracks your payments, reminds you about the next installments, and saves all about your spending.